Local economic circumstances will drive the best and worst property growth across the country this year, with improved prospects for gas pushing up prices in Queeensland’s Toowoomba and car industry job losses sending prices sliding in the Adelaide suburb of Kilburn.

Forecasts by property consultancy firms MacroPlan Dimasi and Australian Property Monitors show that Queensland will host four of the six best performing suburbs for home value growth this year, with the low Australian dollar boosting key industries in the state.

Suburbs in South Australia, Canberra and some iron-ore producing towns in Western Australia will stall, as the industries that employ large numbers of people in these areas face a tougher year.

Brisbane’s Dutton Park on the fringe of the city and the outer western Redbank Plains will be two of the country’s top performers, growing by a forecast 10 per cent, with the whole city expected to reap the rewards of renewed confidence.

MacroPlan Dimasi chief economist Jason Anderson said that rising inner city rents in Brisbane this year would see more demand for city fringe apartments, while the affordability of Redbank Plains would stoke the interest of a more confident first-home buyer cohort, returning to the market after low levels last year.

Brisbane local David Cowling plans to take advantage of the prospect of more demand from renters in Dutton Park, buying an apartment off-the-plan last year for $525,000. The 65-apartment complex, developed by Silverstone, will be finished in May, with all apartments sold, most within the first two weeks of marketing.

Mr Cowling said that Dutton Park had all the amenities that the close by but more expensive West End did, but was better value for money as it did not have the “hip” reputation.

“It’s just outside that city ring and I think it could be the next place to move,” he said.

“If this happens then the rents will rise and the value of the place will rise, which is a great opportunity,” Mr Cowling said.

A couple of areas in the still hot, but cooling Sydney will be the only ones to match Brisbane, with the inner west set to grow by 10 per cent, and outer western Penrith by 8 per cent.

The worst performers will fall in value by about 5 per cent, with Adelaide’s Kilburn to suffer from Holden’s manufacturing exodus, Canberra’s Tuggeranong to feel the pain from the expected public service cuts, and apartments in the Melbourne central business district and Docklands to feel the pinch from an oversupply of residential buildings.

The iron ore and coal producing resource towns of the Pilbara in Western Australia and Gladstone in northern Queensland are likely to feel the headwinds from a drop in mining construction – especially Gladstone, with home values expected to drop by about 3 per cent.

Back in Queensland, tourism-reliant Cairns will fare well from a falling dollar, with property prices rising by about 7 per cent.

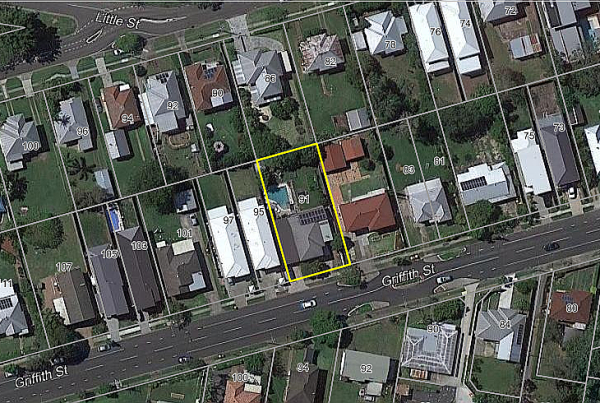

And Toowoomba will surge by 8 per cent, being close to the Surat Basin gas industry, which is in the early stages of a growth cycle.

Story: Greg Brown Source: www.theaustralian.com.au

House prices are on the rise. Find out the value of your property now.

Get a free online property report from Hicks Real Estate. It takes seconds.