Downsizing? – Now you will be able to put the proceeds in your Super, from 1 July 2018, the Australian Government has introduce the Contributing the proceeds of downsizing into superannuation (downsizing) measure. This measure is part of a package of reforms to reduce pressure on housing affordability in Australia.

Downsizing contributions into superannuation

This measure applies to the sale of your your home, which was your main residence, where the exchange of contracts for the sale occurs on or after 1 July 2018.

If you are 65 years old or over and meet the eligibility requirements, you may be able to choose to make a downsizer contribution into your superannuation of up to $300,000 from the proceeds of selling your home.

Your downsizer contribution will not count towards your contributions caps or be affected by the total superannuation balance test in the year you make it.

You can only make downsizing contributions for the sale of one home. You can’t access it again for the sale of a second home.

Downsizer contributions are not tax deductible and will be taken into account for determining eligibility for the age pension.

If you sell your home, are eligible and choose to make a downsizer contribution, there is no requirement for you to purchase another home.

Eligibility for the downsizer measure

Eligibility for the downsizer measure

You will be eligible to make a downsizer contribution to super if you can answer yes to all of the following:

- You are 65 years old or over at the time you make a downsizer contribution (there is no maximum age limit).

- The amount you are contributing is from the proceeds of selling your home where the contract of sale was exchanged on or after 1 July 2018.

- Your home was owned by you or your spouse for 10 years or more prior to the sale.

- Your home is in Australia and is not a caravan, houseboat or other mobile home.

- The proceeds (capital gain or loss) from the sale of the home are either exempt or partially exempt from capital gains tax (CGT) under the main residence exemption.

- You have provided your super fund with the downsizer contribution form either before or at the time of making your downsizer contribution.

- You make your downsizer contribution within 90 days of receiving the proceeds of sale, which is usually the date of settlement.

- You have not previously made a downsizer contribution to your super from the sale of another home.

Downsizer contribution amounts

If eligible, you can make a downsizer contribution up to a maximum of $300,000. The contribution amount can’t be greater than the total proceeds of the sale of your home.

Example 1

A couple sell their home for $800,000:

- Each spouse can make a contribution of up to $300,000.

Example 2

A couple sell their home for $400,000:

- The maximum contribution both can make cannot exceed $400,000 in total.

- This means they can choose to contribute half ($200,000) each, or split it – for example, $300,000 for one and $100,000 for the other.

Main residence exemption

The proceeds from the sale of the home are either:

- exempt or partially exempt from capital gains tax (CGT) under the main residence exemption

- would be entitled to such an exemption if your home was a CGT rather than a pre-CGT asset (that is, you acquired it before 20 September 1985).

Timing of your contribution

You must make your downsizer contribution within 90 days of receiving the proceeds of sale. This is usually at the date of settlement.

Making multiple contributions

You may make multiple downsizer contributions from the proceeds of a single sale.

However, the total of all your contributions must not exceed $300,000 or the total proceeds of the sale less any other downsizer contributions that have been made by your spouse.

You need to make all contributions within 90 days of receiving the proceeds of sale, usually the date of settlement, unless you have been granted an extension.

How to make a downsizer contribution

Before you decide to make a downsizer contribution, you should:

- check the eligibility requirements for making a downsizer contribution

- contact your super fund/s to check that they accept downsizer contributions.

You may also wish to seek independent financial advice in relation to the age pension asset tests.

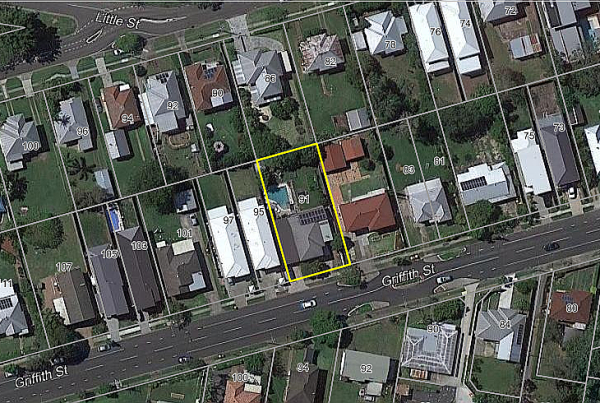

House prices are on the rise. Find out the value of your property now.

Get a free online property report from Hicks Real Estate. It takes seconds.