If you add it all up, those strata levies you pay for facilities such as pools, gyms and concierges can be good value.

There’s increasing angst among some apartment owners about high strata levies, which for some can be more than $20,000 a year. No-frills apartments with low levies are becoming more popular.

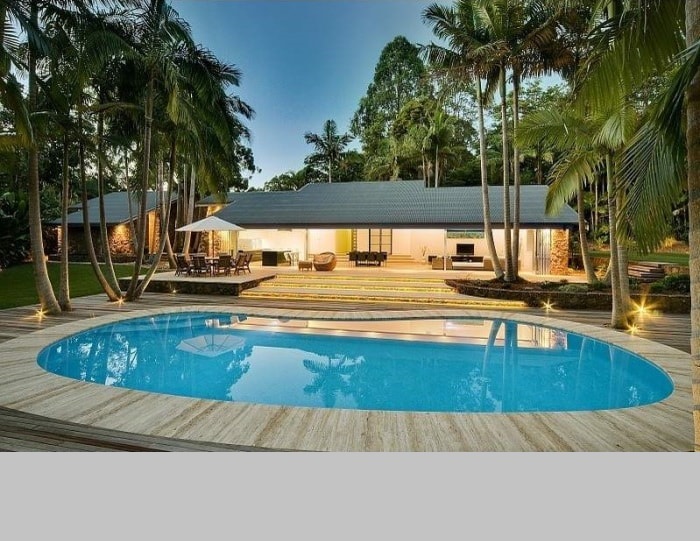

But developers also say many buyers, particularly owner-occupiers, are prepared to pay for the many lifestyle facilities that some big Sydney complexes offer: pools, gyms, spas, concierges and even rooftop cinemas. Others have tennis courts, music rooms and libraries.

General manager of developments with the Crown Group, Pierre Abrahamse, says inner-city buyers especially are keen on in-house facilities.

”If you don’t have the facilities in the building and people want to work out or go to a swimming pool, they’re going to have to join a gym or go to the local pool anyway,” he says.

”Having facilities within the building gives people that level of convenience.”

Strata levies also pay for the lift maintenance, gardeners, cleaners and other costs associated with a building’s upkeep.

Domain Flat Chat columnist and the editor of flat-chat.com.au, Jimmy Thomson, says buying in a block with a lot of facilities can make financial sense.

”It seems to be that people will pay the levies to live in the kind of community that they want to be in, even if they don’t want to use the facilities,” he says. ”It’s a terrific selling point to say [these facilities are] there.”

This was the case with psychologist Julio Modesto, who recently bought a two-bedroom, two-level apartment in a building in Surry Hills through McGrath agent Ben Forsyth. The levy of $1800 a quarter paid for a pool, gym and a weekday concierge service and was money well spent, he believes.

”You do pay a bit more money in terms of levies but that also gives you the opportunity of not having to pay any gym membership or other expenses,” he says.

”It’s also quite convenient; you can access the facilities pretty much whenever you want and it’s at your doorstep, so there are no limitations on that.”

Thomson says the hard part is working out what is a ”fair” levy, as there are often many variables, such as the number of units versus the types of facilities on offer. But ”as a really rough rule of thumb”, he estimates owners should pay between 0.7 per cent and 1.2 per cent a year of the purchase price in a large, well-maintained block, and between 0.4 per cent and 0.7 per cent for townhouses and developments with no facilities.

Having levies set too low can be just as problematic for buyers as those that are too high because it could mean the buildings are not maintained properly.

Strata lawyer Stephen Goddard, head of the Owners Corporation Network, says apartment buyers are realising they cannot live in a building with all the bells and whistles and not pay for them.

This realisation is forcing many, especially those on fixed incomes, to look for apartments with low levies and fewer facilities. But he cautions that all levies have to be adequate to cover the costs of running a building.

”The value of your investment is only ever as good as the collective maintenance,” he says.

”If a levy is too low then the building is on a slippery slope to a degraded position in the market.”

Story by Antony Lawes Story source: www.domain.com.au

House prices are on the rise. Find out the value of your property now.

Get a free online property report from Hicks Real Estate. It takes seconds.